Mortgage rates have drawn national attention over the past year as COVID-19 caused a serious drop across North America. Buyers who got into the market at this time were paying as low as 1% with the sharp decline. This lower rate was partly implemented in order to increase lending and keep the economy afloat during the pandemic. Despite a minor rise in mortgage rates recently in 2021, they are still considerably low given historical records.

It is always difficult to know whether or not to buy a house in the ever-shifting Canadian housing market. Choosing a mortgage type is one of the biggest decisions you will make as a homebuyer and it’s worth weighing the pros and cons of your options.

Why does mortgage type matter?

The type of mortgage you get is very important. There are a variety of options for buyers to suit different needs. However, ultimately the mortgage you choose needs to be sustainable and affordable for you in the long run.

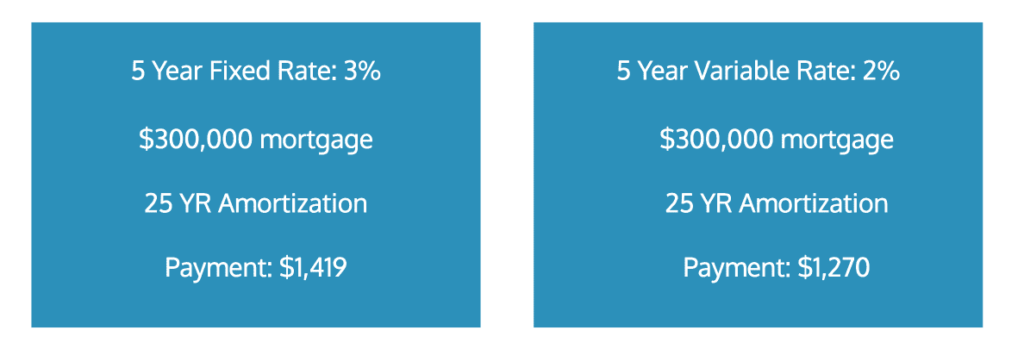

The right mortgage type can save you money, as seen in the example scenario pictured below. For example: A fixed-year mortgage is typically slightly higher, yet more secure. You know what to expect and set the same amount aside for payments each month. Conversely, a variable mortgage fluctuates with the prime rate, but in times like this in 2021, when rates are low, you can save a considerable amount of money if you are not locked in to a fixed-rate mortgage.

Example Mortgage Scenario: Fixed vs Variable

Comparing Variable vs Fixed-Rate Mortgages

Fixed-Rate

A fixed-rate for the length of your mortgage term

- Consistent, does not fluctuate

- Locked in rate for a set timeline (1-5 years, in some cases 10+)

- Typically higher cost than variable

- Predictable, you know what to expect each month

Variable Rate

Variable rates fluctuate when the prime rate changes.

- The mortgage rate can change monthly

- The price can fluctuate both up and down

- Unpredictable, but can be locked in at any time

- Historically it performs best with regards to cost savings

Why would I choose a fixed-rate mortgage?

Fixed-rate mortgages are popular due to their stable, predictable nature. They offer a fixed mortgage rate over a set period of time called a mortgage term. At the end of your term, you can renew your mortgage but your rate may change. The fixed-term holds your mortgage rate steady and ‘locked-in’ until your term is up.

This is beneficial for those who can lock in a fixed-rate mortgage while rates are low because they will be protected from market volatility.

Conversely, fixed-rate mortgages are not always ideal when mortgage rates drop and you are already locked into your existing, higher rate.

Ultimately, many homeowners like fixed-rate mortgages for their predictability and long-term consistency. They know what to set aside each month in order to pay their mortgage and there are no unexpected spikes or drops in the cost.

Traditionally in Canada, the most popular mortgage type has been the 5-year fixed-rate plan. This mortgage guarantees the buyer 5 years of a sustainable, consistent mortgage rate. At the end of the term, the buyer can re-assess their needs and renew their mortgage with a different plan if desired. The traditional lean towards a fixed-rate mortgage, however, has changed in the past two years as the rates dropped considerably. Buyers saw a better opportunity in flexible variable-rate mortgages.

Why would I choose a variable rate mortgage?

Variable mortgages are the opposite of fixed-rate mortgages. They fluctuate as the prime rate changes.

This is beneficial because you have more flexibility and there is the opportunity to pay less if mortgage rates are low. Unfortunately, in times when mortgage rates are rising, you may also have to pay more.

The key benefit to variable-rate mortgages is that you have the opportunity to lock in your rate at any time. So if mortgage rates are dropping and they are lower than when you purchased your home, you can lock in the rate and convert to a fixed-rate mortgage at a lower rate than what you would have had when you initially purchased. This means that you will pay less interest to the lender in the long run.

Which mortgage type is more popular in 2021?

In 2021, due to the mortgage rate volatility and consistently dropping rates, variable mortgages are currently the most popular option for buyers.

Variable rates are a great option when the rate is low and if buyers use pre-payments to accelerate their existing monthly payments while rates are down, they can essentially pay their mortgage down faster and save money.

Is a fixed or variable rate mortgage better historically?

Historically, the variable rate has performed better, for those who take full advantage of it during rate drops.

The cost savings are higher overall with variable mortgages but ultimately, you should be looking to lock in your variable rate when the rates are low.

Can I get the best of both worlds?

If you’re still on the fence about fixed vs variable mortgages, we have some good news for you. Variable rates have the potential to give buyers the best of both worlds.

With variable rates, you have the ability to lock in your variable mortgage rate at any time. This means that you can lock in your rate when it’s low and pay that rate consistently for the duration of your newly fixed-rate mortgage term. This bypasses the typically higher rates seen in fixed-rate mortgages as you ultimately lock in the price of your variable rate.

How to do it

Talk with your lender about locking in rates and ask specifics on how it’s done. Different banks and private lenders have different policies, and many also have discounts for those who switch from a variable to fixed mortgages. It’s best to inquire and get advice from professionals.

Things to watch out for

Timing

The key risk to consider when locking in your mortgage rate is timing. During COVID-19 rates were dropping very rapidly and there were new updates daily. Many variable rate buyers locked in their rates when they thought the rate could not drop further. When it did, they had already missed out on locking in their mortgage at a much lower rate. Be sure to check historical records of the mortgage rates to get a sense of what is considered high and low.

Penalties & Fine Print

Before you choose your mortgage, be sure to read the fine print and ask your lender about locking in your rate. Check for discounts or, conversely, any additional fees for switching.

When to lock in your rate

Lock in your rate when mortgage interest rates are low. If you are unsure whether or not it’s a good time to lock in your mortgage at its current rate, use our mortgage affordability calculator to test different payment scenarios and determine whether or not the rate you have is cost-effective for you longer term.

How has COVID-19 changed the outlook for 2021?

COVID-19 has significantly impacted mortgage rates in Canada. We have seen many buyers opting for the variable rates, due to the incredibly low prices currently available.

The low rates were initiated largely to stabilize the economy during the pandemic and this created a surge in home buying.

For those looking to buy in 2021, the outlook is good. You may still be able to benefit from incredibly low rates as there is no sign that rates will spike significantly for the remainder of this year.

How can a mortgage broker help?

A mortgage broker with your best interest in mind will work with you to assess your unique goals and current situation.

They will use their extensive knowledge of the economics behind mortgage rates and overall market awareness to make a more informed decision. You may also be able to access insider information and find better mortgage lenders who can offer better variable rates

Which one is best for you in 2021?

It is difficult to pick a side when it comes to choosing a fixed vs a variable rate mortgage. Ultimately the decision is yours to make as it’s directly related to your needs.

Fixed mortgages are ideal for those on a set budget, who require consistent payments. They are also more predictable in general and are ideal for those who like to know what to expect each month.

Variable-rate mortgages are an excellent option in 2021 as mortgage rates are still very low. Payments will be lower and you have the potential ability to pay your mortgage off faster as a result.

For those who are not quite sure, a variable mortgage is a great solution for you. You have the ability to lock in your rates at any time, so you get the flexibility of a variable mortgage with the ultimate consistency of a fixed-rate mortgage.

Get the best deal on your mortgage with Rampone-Marsh Mortgages

In an unpredictable market, it’s difficult to navigate the vast landscape of fixed vs variable mortgage rates in Canada. At Rampone-Marsh Mortgages, we bring years of knowledge and experience in everything they do. We’ll work with you to get a sense of your needs, goals, and unique circumstances and set out to find you the right mortgage. Connect with us – we are more than happy to help you save money on your mortgage.